Recent studies have shown that CFOs are investing in finance training and development to increase employee retention rates.

A basic knowledge of financial statements and calculations is necessary in any department. Find out 5 Accounting Instruments that every professional should know...Download our "Basic Financial Intelligence Case Study" to put your financial intelligence skills into practice. Perfect financial training activity!

How do you know if your department is doing well? What about your organization?  More importantly, how can you contribute to the financial success of your department and your organization? The answer is by gathering, interpreting, and evaluating the financial data of your organization.

More importantly, how can you contribute to the financial success of your department and your organization? The answer is by gathering, interpreting, and evaluating the financial data of your organization.

In today’s economy, organizations are doing more with less. They’re demanding more productivity from every employee and looking for every possible measure to improve the bottom line. And they’re expecting their employees to monitor and drive this process themselves.

Financial statements and instruments reveal important information about your organization’s financial health by highlighting areas where your organization performs well and areas where there are opportunities for improvement. By learning how to read and interpret a few basic financial instruments, you can recognize opportunities to increase revenue and shave expenses, thus increasing your value to the organization.

Learn more about all our financial service training solutions...

We'll look at five financial instruments that will help you and your team make decisions and influence the success of your organization.

Budget

Budgeting can be as simple or as complicated as you want to make it. Use this three-part process and simplify or elaborate on it based on the needs of your department and your organization.

1. Create your budget.

2. Track and report the information in the budget.

3. Analyze and make course corrections.

The easiest way to create a new budget is to start with a previous budget. Then take your annual strategic plan (if you have one) and a list of the specific activities under your jurisdiction required to achieve the strategic plan and your organization’s goals. With that information, you’ll need to make several calculations:

• Establish your monthly profit goals.

• Establish revenue targets.

• Forecast variable costs. (These change as revenue changes.)

• Forecast fixed expenses. (These are usually easier to forecast.)

• Forecast net profit.

There are three important questions to ask when analyzing your budget:

How are we doing compared to budget?

Why did the actual results differ from the plan?

What must we do now to ensure a better result next month?

The following attributes help ensure the effectiveness of any budget.

Balance Sheet

The balance sheet and income statement are the instruments most commonly used to measure an organization’s financial success.

Purpose: The balance sheet provides a picture of a company’s assets, liabilities, and equity in the form of this essential equation:

Assets = Liabilities + Equity.

Assets: Things a company owns that have value.

• Cash, investments, accounts receivable

• Inventory: materials, work in progress, finished goods

• Physical property: equipment, plants

• Intangibles: trademarks, patents, goodwill

Liabilities: Money a company owes to others.

• Accounts payable, rent, payroll, and taxes

• Borrowed money

•Obligations to provide goods or services to customers in the future.

Shareholders’ equity: Money left if a company sold all of its assets and paid off all of its liabilities. This leftover money belongs to the owners or shareholders of the company.

Income Statement

Think of an income statement as a set of stairs. Start at the top with the total amount of sales made during the accounting period. Then go down one step at a time. At each step, deduct certain costs or operating expenses. At the bottom of the stairs, after you’ve deducted all the expenses, you reach the net earnings—how much the company earned or lost. This is the proverbial “bottom line.”

The bottom line is calculated using this equation:Net earnings = Revenues — Expenses.

The income statement consists of two basic parts: revenues and gains, and expenses and losses.

Revenues and Gains

Operating revenues: income earned from the sale of goods and/or the provision of servicesNon-operating revenues (e.g., interest on cash or rent from property owned)Gains (e.g., profit on sale of long-term assets or gain on lawsuits)

Expenses and Losses

• Cost of goods sold (COGS): expenses directly related to producing a good or service

• Operating expenses: usually subdivided into selling, administrative, and general expenses

• Non-operating expenses: expenses not related to the core operations of the business (e.g.interest expense, costs incurred from restructuring)

• Losses (e.g., loss on sale of long-term assets, loss on lawsuits)

• Taxes

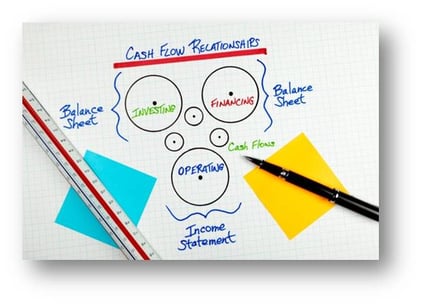

Statement of Cash Flows

Purpose: The statement of cash flows provides information about cash used for  operations, for investing activities, and for financing activities.

operations, for investing activities, and for financing activities.

• Operations: items identified in the income statement, usually sales, cost of sales, operating expenses, and extraordinary items.

• Investing activities: purchase of property, equipment, securities, or other non-operating assets.

• Financing activities: debt borrowing and repayments, contributions and withdrawal of equity capital, and payment of dividends to owners.

To use the statement of cash flows effectively, compare cash from operating activities to net income.

• If the cash is consistently greater than net income, the net income is considered high quality.

• If the cash is consistently less than net income, investigate why the reported income isn’t turning into cash.

Break-Even Analysis